Before we begin to understand the best ways to create finance training programs, let’s look at the losses that take place at a massive scale when such programs are not in place.

$100 million ⇒ Losses from one of the biggest identity theft cases undertaken by a software company employee named Philip Cummings.

$1.1 billion ⇒ Fine paid by Standard Chartered Bank for poor money-laundering controls.

$74 billion ⇒ Losses suffered by Energy company Enron due to one of the biggest financial scandals on Wall Street.

What are the common causes of these incidents?

Lapses, plus lack of accountability and knowledge.

If there had only been proper corporate financial training programs in place to keep things in check, such losses could have been avoided.

However, delivering training to financial organizations requires a unique approach.

Why?

These sectors face challenges, such as the need to navigate numerous regulatory and compliance laws, time constraints, and hectic employee schedules, to name a few.

An effective corporate financial training program can help employees stay updated on the latest financial developments and help them make sound investment decisions for their organization.

We know it’s not easy to put such a program in place before learning all about its requirements. But don’t worry. After reading this blog, you’ll learn everything you need to know to create an effective training program.

What Is a Corporate Finance Training Program?

A corporate finance training program is a method used to train employees on the best practices to acquire, manage, and use corporate funds. It covers:

- Business investments

- Income & expenditure

- Risk management

- Cash flow management

The training imparts knowledge on financial problems related to investors and helps employees understand financial terms and concepts.

The responsibilities of employees associated with corporate finance are immense since their responsibilities include making critical financial decisions that impact shareholders.

They are also responsible for preparing short-term and long-term financial plans, which include substantial risks.

For example, market risks, credit risks, liquidity risks, operational risks, and legal risks are some of the most prevalent risks that most companies face.

That’s why you should appropriately train employees associated with corporate finance on the essential concepts and skills required to perform their jobs effectively.

Watch: What is Employee Training

Why Is Corporate Finance Training So Important?

The responsibilities assigned to corporate finance employees are immense and involve high risk. They need to be aware of the risks they can get exposed to and how to manage & mitigate them. Be it credit risk, AML risk, operational risk, or reputational risk, employees must be very mindful and make each financial decision with extreme caution.

This is where corporate finance training programs become relevant and play an influential role. They let heads of L&D departments ensure that every employee has taken relevant courses and completed the post-training assessments.

Corporate finance training is vital because it helps your employees stay on the same page. It also provides a broad understanding of the essential financial concepts for making sound financial decisions.

- Imparts Knowledge of Company’s Value Creation

Some investments might look expensive initially, but if you see the long-term benefit, you can create ample growth opportunities for the company. Good investments always create value and add to the company’s output.

By providing corporate financial training, you help employees see the benefits of many expenditures, which they wouldn’t have realized if the training was not provided in the first place.

- Gives a Better Understanding of Cost-Cutting Methods

Financial training helps employees think about the financial aspects of their work. With the right corporate finance online courses, employees can be trained to improve working processes over time to reduce cost and enhance organizational efficiency.

Changes in operational processes and administrative practices tend to grow roots within organizations and make cost-saving a habit for employees who have been sensitized through online financial training courses.

- Equips Employees with Essential Financial Skills

Employees in charge of managing company finances must be trained in financial skills to eliminate inefficiencies at work and improve accounting practices.

Employees need to demonstrate certain financial skills such as analytical thinking, accounting skills, interpersonal skills, technological skills, communication skills, dexterity, wealth management, and more to perform their jobs.

A training program can equip employees with the skills they need to carry out their duties.

- Delivers Knowledge on Stock Performance

An increase in stock doesn’t mean that the company is performing well. Corporate finances do not work on this principle.

A training program can help employees master the art of reading a company’s stock performance to provide a bird’s eye view of potential problems. With proper training, employees can efficiently act and prevent such problems from occurring.

- Helps in Understanding Mergers and Acquisitions

Mergers and acquisitions are essential corporate finance topics that should be covered in employee training. Without such training, employees fail to realize the importance of what that merger means to the company. There can be various reasons why an organization may want to merge with other organizations.

It can be for broadening the range of products and services or reducing costs and risks. By getting trained on these topics, employees will better understand the reasons behind the company’s budgeting needs, financial decisions, and more.

Examples of Corporate Finance Training Topics

Corporate finance is a comprehensive subject with lots to cover. While designing your corporate training financial program, you should cover the following corporate financial training topics:

- Compliance Training

Compliance is important in the financial sector to meet the key regulatory objectives to protect investors and eradicate financial crimes and systems risks.

Compliance training includes topics on rules, regulations, and guidelines for making decisions on when to invest or sell and buy on behalf of the shareholders.

This kind of training is more than just informing employees on what needs to be done. It talks about the policies and regulations governing their department and job roles.

Such regulations may change from time to time, so your employees need to be familiar with those amendments to stay updated.

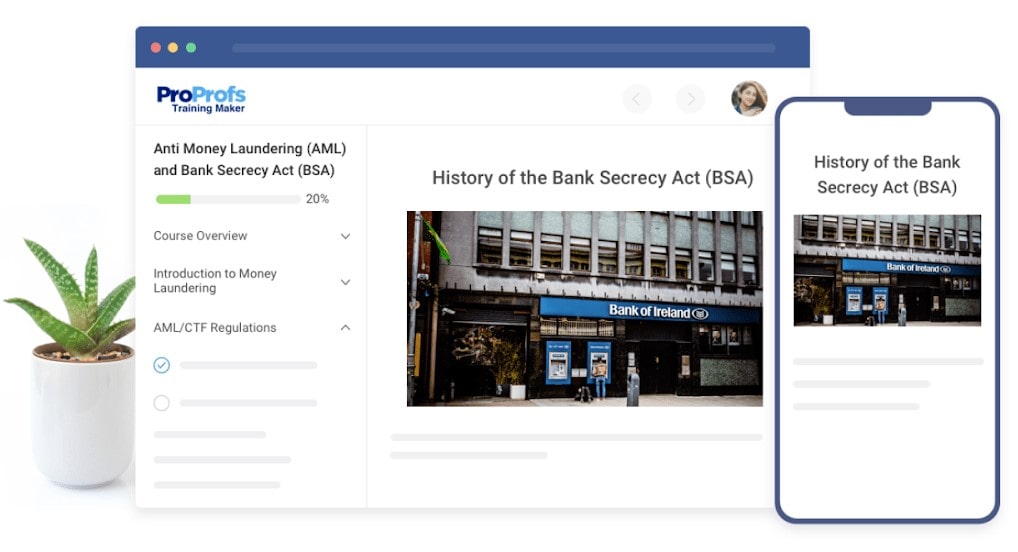

- Anti-Money Laundering Training

An AML training program covers training on policies and procedures that prevent money laundering. These policies are put in place to prevent criminals from transferring illicit funds into the financial system.

Through proper training, employees can be equipped with the right tools and knowledge to quickly identify any kind of fraudulent transactions and unearth evidence of the same. They can also identify financial risks and correctly apply the rules and regulations.

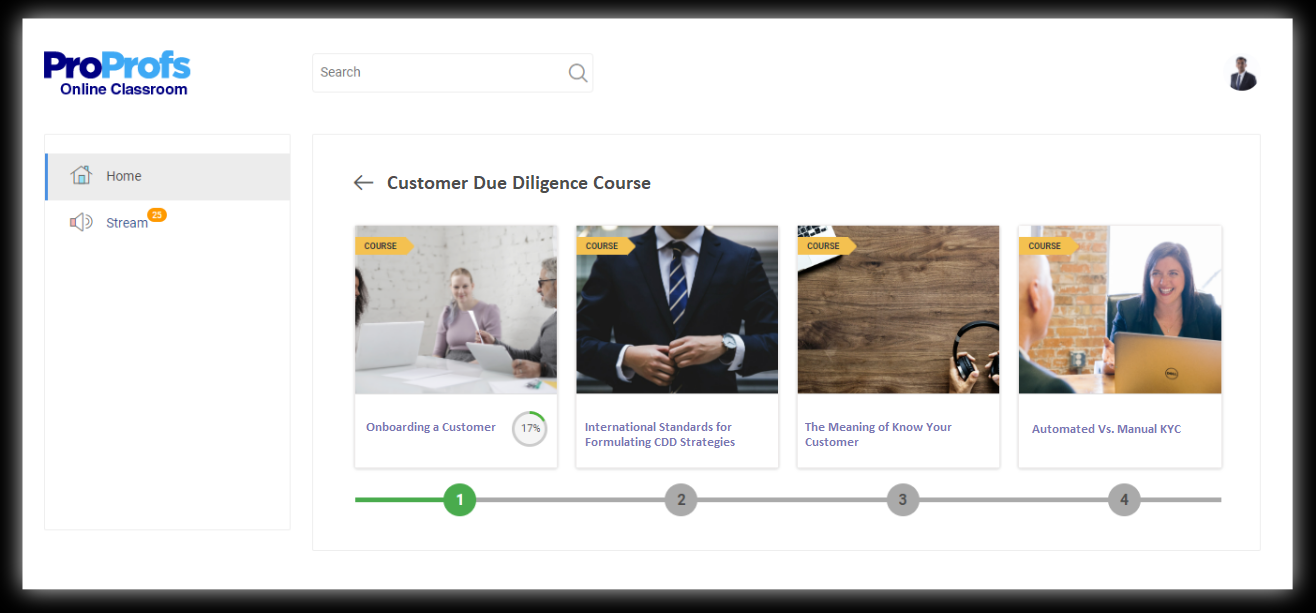

- Customer Due Diligence (CDD) Training

All new staff of financial organizations should be trained in Customer Due Diligence as part of their corporate financial training. Through this training, employees learn to perform background checks on customers and assess the extent to which they can pose a risk to the organization.

Employees with CDD training collect and verify customer information before onboarding and prevent organizations from a variety of risks like terrorist financing and money laundering.

- Cybersecurity Training

The Financial Services Information Sharing and Analysis Center, in its report ‘Navigating Cyber 2022’, explains that ransomware groups, zero-day vulnerabilities, and third-party risks will adapt to the changing cyber environment and will continue to pose threats to financial organizations.

On top of that, new technological improvements have made it more challenging to prevent cyber threats. Even the most experienced financial manager needs continuous training to stay updated on the new hacking strategies, threats, or viruses from hackers, so this can be one of the top finance manager courses to consider.

Watch: What Is Security Awareness Training Course

Employees should be given cybersecurity training to empower them, develop a security-focused culture, protect assets, and prevent downtime.

- Fraud Detection Training

Corporate finance employees must be given Fraud Detection training to give them a clear perspective of the real-world frauds and the procedures to identify the extent and type of fraud.

This kind of training should be imparted with real-life scenarios and examples to help employees easily identify suspicious activities or patterns.

- Skills Training

The corporate finance sector demands employees to possess important soft skills like communication, negotiation, problem-solving, analytical, and critical thinking skills.

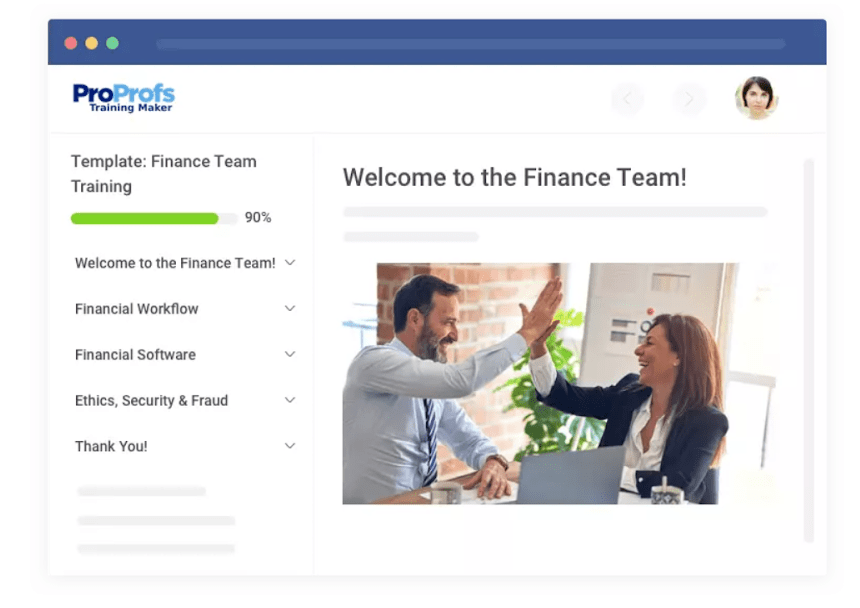

Besides this, corporate finance employees should also have a basic knowledge of ERP systems to automate financial and accounting tasks. You can use corporate financial training templates to train your employees on financial software, financial workflow, and other essential topics.

Train your employees on the top financial skills to make them stay relevant to business requirements and keep pace with fast-changing industry trends.

How to Create a Corporate Finance Training Program

As with all training programs, you need to effectively plan to achieve learning objectives, whether it is for finance manager training or someone at an entry level.

Here are the steps you need to keep in mind to create the training program:

Step #1: Find out Employees’ Training Requirements

Assessing prior knowledge of employees is crucial to making a training program successful. What your employees know and what they need to learn to perform their duties is important.

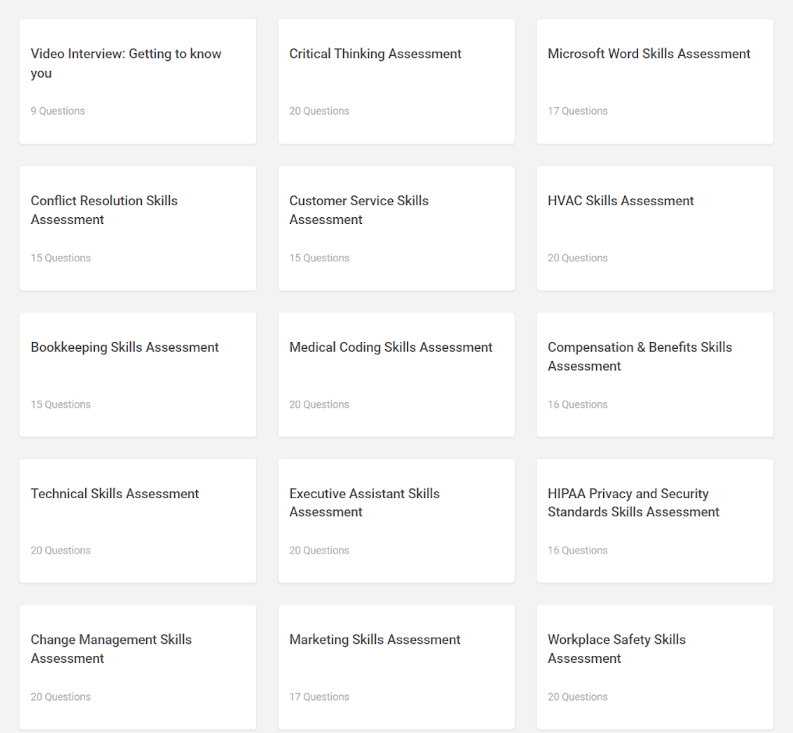

Conducting pre-training assessments goes a long way in identifying the employees’ current skills, competency, & knowledge and then comparing it to the company’s benchmark. It’s a great way to identify knowledge gaps and uncover training needs.

Your training program should cater to the learning needs of employees. For instance, entry-level managers should undergo basic financial literacy training because they need more knowledge of the basics than experienced managers.

Step #2: Assess the Areas to Target

Once you figure out what your employees know, it becomes easy to plan which areas to target. Focus on the corporate finance online courses that’ll help employees achieve their learning needs.

Choosing topics based on learner needs is important because it keeps your employees engaged. Providing training on topics they already know is just a waste of time, and it also turns them off.

For example: They may need a refresher course on finance or need to be trained on something to improve their communication skills as well.

Or they may need training on how to automate financial tasks using spreadsheets or some specific software.

Step #3: Choose the Best Courses

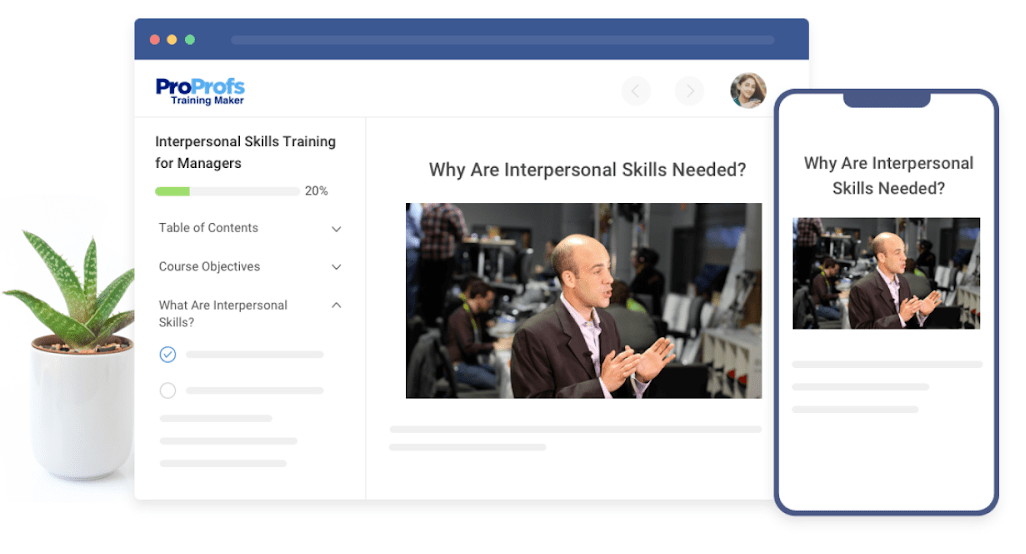

When training your corporate finance employees, you need to select the right courses, as discussed in the section above, to meet the learning objectives. You can use a Learning Management System (LMS) for this purpose.

With many LMS software, you get access to a premium course library for instant use. Or, you may also create your courses from scratch by importing existing content.

Watch: How to Create an Online Course

Step #4: Make your Content Engaging

- Add multimedia to your content, such as images, videos, PDFs, and presentations, to make it engaging. You may also deploy gamified employee training software to enhance your learner’s interest levels.

Watch: How to Add Media to Your Online Courses

- If your training courses are lengthy, break them into small chunks for better knowledge retention and create learning paths that can help you and the learners map the course progress, as demonstrated below:

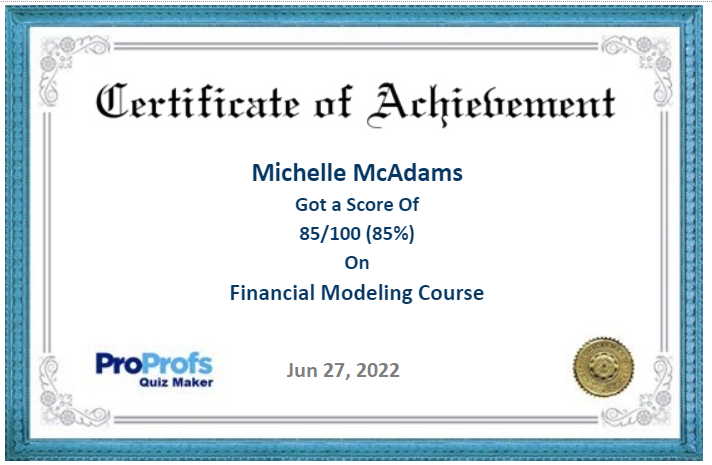

- You can also hand out certificates on course completion to give a sense of accomplishment.

Step #5: Choose the Best Way to Deliver Training

Corporate financial training may sound like a boring and dull subject area, especially for employees who are not directly associated with managing finances. Incorporating different ways of delivering online training can be a great way to enhance employee engagement.

There are plenty of ways to deliver your corporate finance training, such as

- Videos

- Webinars

- Live streaming

- Group sessions

- Learning in person

- E-learning modules

You can choose the training delivery method based on your business needs and learners’ preferences.

Step #6: Choose the Best Tool

Now that you’ve listed all the delivery methods, your next step is to pick the right tool. For corporate finance training, an LMS would be the best option. Since the market is flooded with a plethora of choices, it’s important to consider several factors before choosing the right training solution.

Watch: How to Choose the Best LMS Software for Employee Training

Features to consider when choosing LMS software:

- Course templates

- E-learning authoring

- Virtual classrooms

- Collaboration tools

- White labeling

- Quiz-making

- Real-time, intuitive reporting

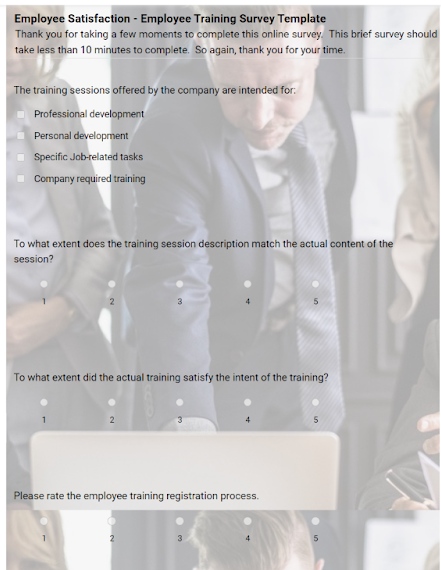

- Feedback surveys

- Certificate creation

The tool should also be easy to use, customizable, scalable, and come with excellent support.

Step #7: Implement the Training Program

Organizations must decide whether they want to deliver in-house or online training at this stage. They can also use a blended model with both types of training. Needless to say, online training comes with several benefits of its own. It’s cost-effective, perfect for training employees anytime, anywhere, and also helps assess learners accurately.

That brings us to the next step.

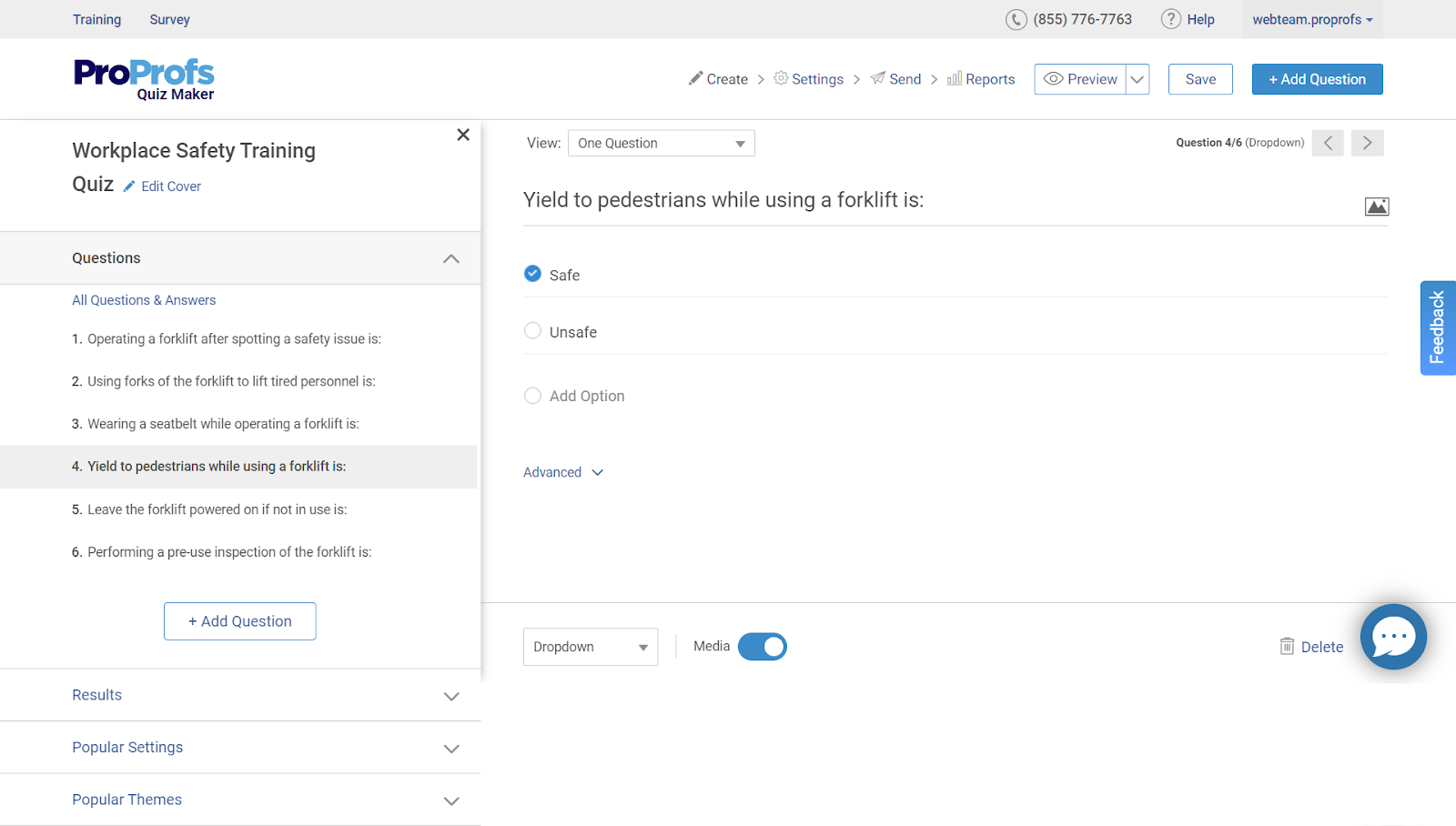

Step #8: Assess Learning Progress

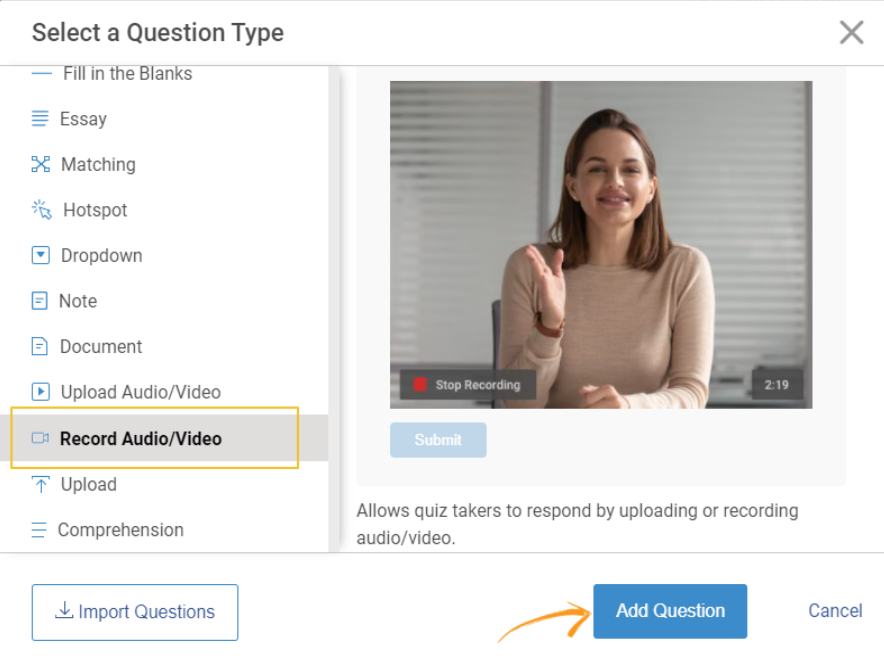

To monitor learner progress, you can add assessments such as quizzes into your courses to keep your employees engaged and assess their progress. They can also repeat a chapter if their assessment results are not up to the mark.

Evaluation is essential to understand if learning objectives were met. With some LMS software, you can build tests using readymade templates and questions. Also, you can record video responses to your questions and prevent question skipping.

Bonus Step: Launch Surveys to Collect Feedback

Corporate financial training can be effective when you integrate feedback mechanisms into your program. You can do this by integrating online surveys at any point in your course to capture feedback from training participants.

Besides evaluating learner progress, it’s equally important to obtain actionable feedback from learners to determine the course quality. You can revise your training program to meet learning objectives based on the feedback.

Get Free Employee Training Software — All Features, Forever.

We've helped 567 companies train 200,000+ employees. Create courses in under a minute with our AI LMS or use 200+ ready-made courses on compliance, harassment, DEI, onboarding, and more!

Ready to Create a Corporate Finance Training Program?

Launching your first corporate financial training program can seem daunting, but if you carefully look at the steps discussed above, you’ll find that they are pretty simple and straightforward.

Ideally, you should start with identifying training requirements and assessing knowledge gaps. This will help you understand the topics you should cover in your program. The training delivery method also plays a key role in determining the program’s success.

Using an LMS would be the best bet. You can create and distribute online courses to employees and also track their progress through automated course reports.

With proper finance training, you can keep your employees updated on the latest financial developments and help them develop expertise to make sound financial decisions for your organization. This way, your company will also succeed financially and can reduce expenses through better regulation.

Tips

Tips

We’d love to hear your tips & suggestions on this article!

Get Free Employee Training Software — All Features, Forever.

We've helped 567 companies train 200,000+ employees. Create courses in under a minute with our AI LMS or use 200+ ready-made courses on compliance, harassment, DEI, onboarding, and more!

We'd love your feedback!

We'd love your feedback! Thanks for your feedback!

Thanks for your feedback!